Purpose of This Report

This presentation refines and amplifies MATH's investment thesis into a "perfect storm" setup by integrating multiple convergent forces that create an exceptional risk-reward profile for sophisticated investors. We examine the intersection of macro instability, institutional cryptocurrency adoption, and company-specific catalysts to demonstrate why MATH represents a compelling asymmetric opportunity at this precise moment in market history.This presentation refines and amplifies MATH's investment thesis into a "perfect storm" setup by integrating multiple

1 Macro Verification Confirming key global debt metrics and systemic fragility indicators that drive capital allocation decisions towards alternative assets

2 Institutional Alignment Analysing major financial institutions' Bitcoin forecasts and their implications for crypto infrastructure plays

3 Catalyst Positioning Examining MATH's upcoming earnings as a pivotal validation event for the growth thesis

4 Comprehensive Framework Integrating valuation models, liquidity metrics, and risk frameworks to complete the investment case

$338 Trillion Global Debt 4 Fragility Meets Opportunity

Global debt reached an unprecedented $337.7 trillion in Q2 2025, according to the Institute of International Finance 4 establishing a new all-time record that underscores profound systemic vulnerabilities in the traditional financial architecture. This staggering figure represents over 320% of global GDP, a ratio that has historically preceded major financial dislocations and capital regime shifts.

The implications extend far beyond mere statistics. Sovereign debt sustainability concerns are mounting across developed economies, whilst emerging markets face refinancing walls that threaten growth trajectories. Central banks remain caught between inflation control and financial stability mandates, creating policy uncertainty that drives capital towards assets insulated from fiat debasement.

This macro fragility creates a powerful tailwind for alternative assets, particularly cryptocurrency infrastructure that offers both scarcity characteristics and technological innovation exposure. Investors increasingly view crypto not as speculation, but as essential portfolio insurance against monetary policy exhaustion.

This macro fragility creates a powerful tailwind for alternative assets, particularly cryptocurrency infrastructure that offers both scarcity characteristics and technological innovation exposure. Investors increasingly view crypto not as speculation, but as essential portfolio insurance against monetary policy exhaustion.

Why Macro Instability Favours Crypto Infrastructure

The current macroeconomic environment presents a confluence of pressures that historically catalyse major capital reallocations. Policy shocks continue to reverberate through markets as central banks navigate the impossible trinity of maintaining growth, controlling inflation, and preserving financial stability simultaneously. Debt sustainability concerns have moved from academic discussion to front-page news, with investors actively modelling sovereign default scenarios and currency debasement trajectories.

In this context, sophisticated capital is executing a strategic rotation from fiat-denominated risk assets towards scarce, mathematically capped alternatives that exist outside traditional monetary policy transmission mechanisms. Cryptocurrency represents both a defensive hedge against monetary debasement and an offensive play on the digitalisation of global finance 4 a rare combination that appeals to both risk-averse and growth-oriented mandates.

In this context, sophisticated capital is executing a strategic rotation from fiat-denominated risk assets towards scarce, mathematically capped alternatives that exist outside traditional monetary policy transmission mechanisms. Cryptocurrency represents both a defensive hedge against monetary debasement and an offensive play on the digitalisation of global finance 4 a rare combination that appeals to both risk-averse and growth-oriented mandates.

Traditional Finance Policy uncertainty, inflation risk, debt overhang, systemic fragility

Capital Migration Institutional rotation towards scarce digital assets and decentralised infrastructure

Crypto Growth Both monetary hedge and innovation exposure in single asset class

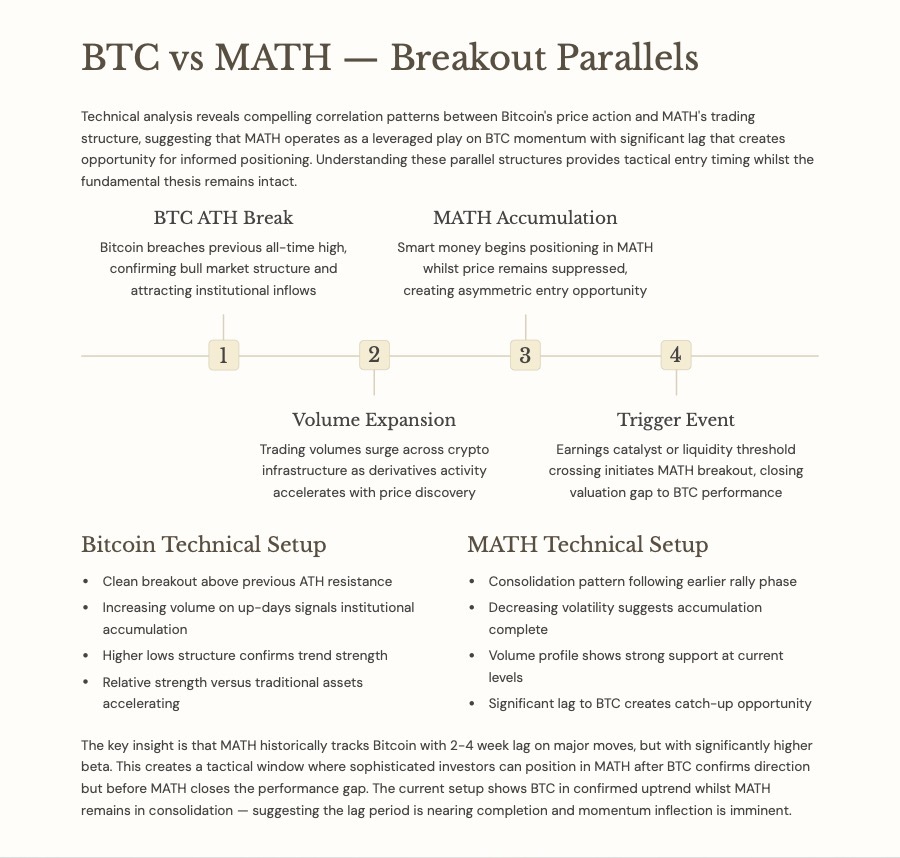

BTC Turns Institutional: The Bull Consensus

A remarkable shift has occurred within the institutional investment community over the past 18 months. Major global financial institutions 4 the very entities that once dismissed Bitcoin as speculative froth 4 now publish bullish research with price targets that would have seemed fantastical mere years ago. This transformation reflects fundamental reassessment of Bitcoin's role in global finance, driven by spot ETF approval, corporate treasury adoption, and recognition of its scarcity value proposition.

The convergence of institutional forecasts around six-figure Bitcoin valuations signals more than optimism; it represents a structural re-rating of digital assets from speculative to essential. When institutions of this calibre commit research resources and reputational capital to bullish crypto theses, capital allocation committees take notice. The targets below represent conservative base cases from banks known for prudent forecasting:

The convergence of institutional forecasts around six-figure Bitcoin valuations signals more than optimism; it represents a structural re-rating of digital assets from speculative to essential. When institutions of this calibre commit research resources and reputational capital to bullish crypto theses, capital allocation committees take notice. The targets below represent conservative base cases from banks known for prudent forecasting:

Standard Chartered $135,000+ target Based on institutional adoption curves and ETF inflow projections

JPMorgan $165,000 forecast Anchored on gold market cap displacement thesis and Bitcoin's superior monetary properties

Citibank $181,000 projection Modelling accelerated institutional allocation and sovereign accumulation

scenarios

scenarios

These targets reflect a fundamental shift: Bitcoin is now viewed as macro infrastructure 4 a legitimate portfolio component for diversified institutional mandates 4 rather than speculative technology play. This institutional alignment creates powerful network effects that benefit the entire crypto ecosystem, particularly infrastructure providers positioned to capture transaction volume and derivative products growth.

Market Media Mirrors the Thesis

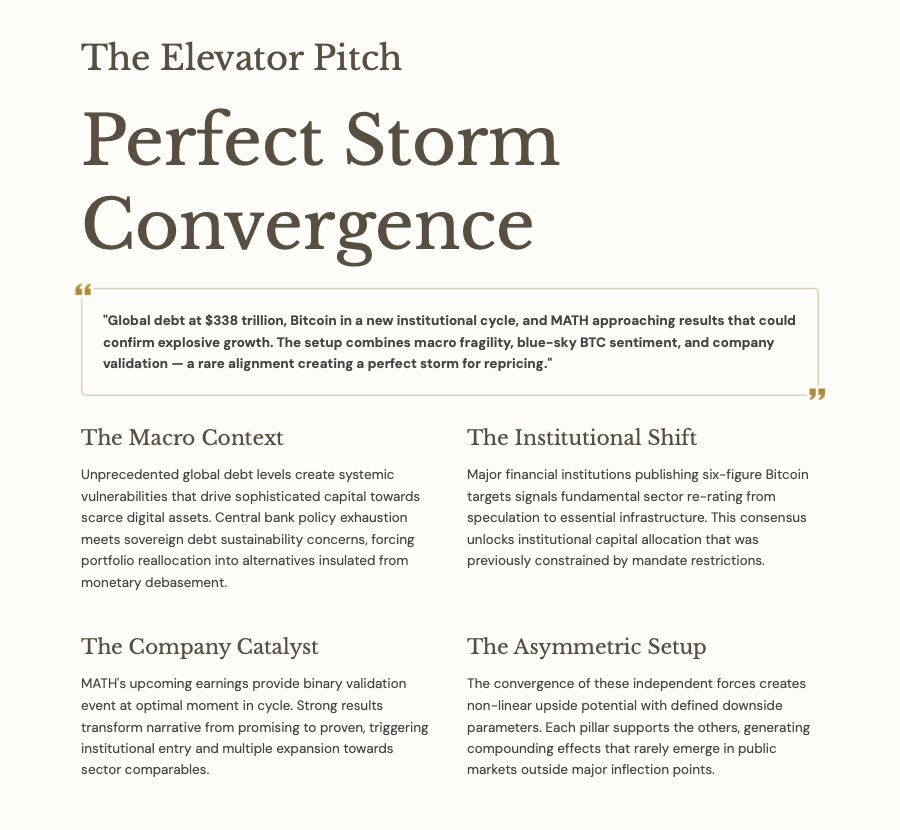

The convergence of macro fragility and institutional crypto adoption has penetrated mainstream financial discourse in remarkable fashion. A recent YouTube headline captured the zeitgeist perfectly: "BTC $122K! Crypto $4.2T ETFs On | JPM $165K, Citi $181K | Debt Crisis $338T!" 4 demonstrating how retail and institutional narratives have aligned around the same core thesis.

This headline encapsulates multiple validating data points in a single breath: Bitcoin's price momentum, total crypto market capitalisation approaching unprecedented levels, major financial institutions' bullish forecasts, and the overarching debt crisis context. The compression of these themes into viral media content confirms that the "perfect storm" narrative has achieved critical mass beyond institutional research departments.

When mainstream financial media begins connecting macro instability directly to cryptocurrency valuations 4 and citing specific institutional price targets 4 it signals that the investment thesis has moved from contrarian to consensus, creating conditions for accelerated capital deployment and multiple expansion across the sector.

When mainstream financial media begins connecting macro instability directly to cryptocurrency valuations 4 and citing specific institutional price targets 4 it signals that the investment thesis has moved from contrarian to consensus, creating conditions for accelerated capital deployment and multiple expansion across the sector.

MATH's Upcoming Q23Q3 2025 Results

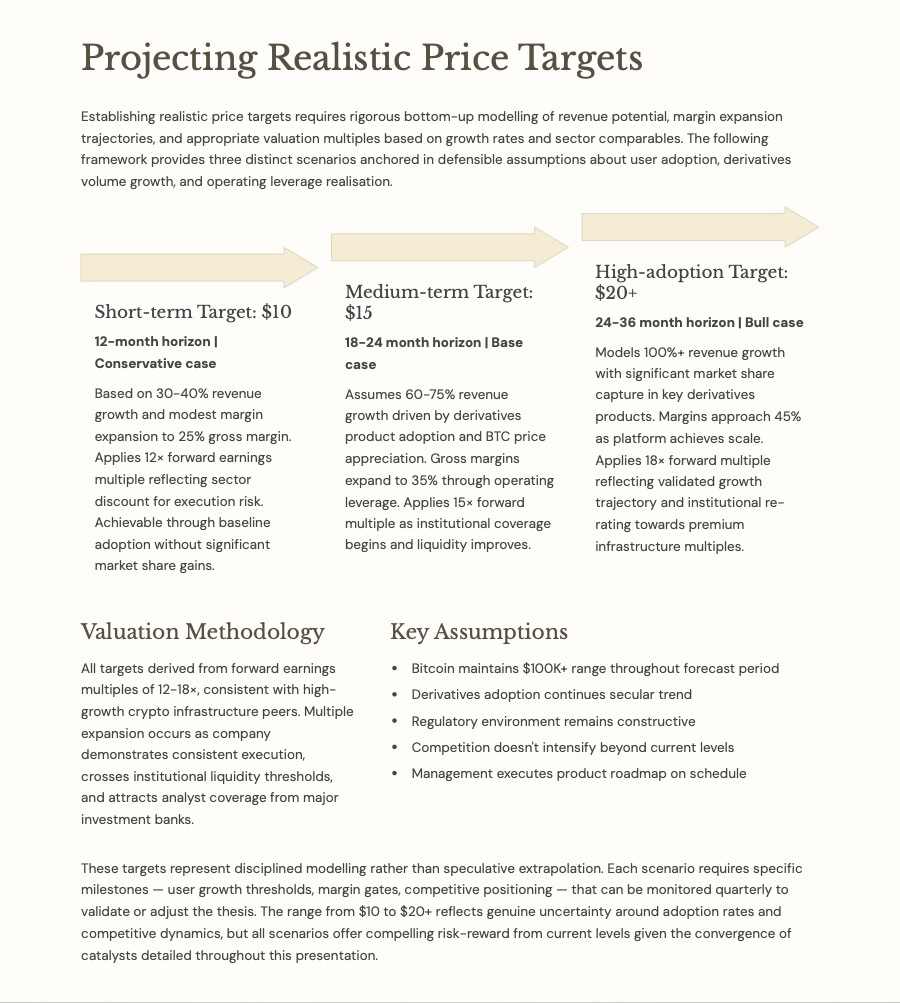

In approximately 40 days, MATH reports its six-month results covering the period ending 30 September 2025 4 a catalytic event that could transform the company's investment profile from speculative growth story to validated execution case. This earnings release arrives at a particularly opportune moment, coinciding with broader institutional crypto adoption and elevated Bitcoin price levels that should translate directly into derivatives volume and margin expansion.

1 Derivatives Product Adoption

Monitoring user acquisition metrics, trading volume growth across perpetual and options products, and market share gains versus established competitors. Strong adoption validates the product-market fit thesis and positions MATH for sustained growth trajectory.

2 Margin and Revenue Acceleration

Examining gross margin expansion as the platform achieves operating leverage, alongside revenue growth rates that should reflect both higher crypto prices and increased user engagement. Sequential improvement here signals business model scalability.

3 Net Income Inflection

The critical validation point 4 whether MATH demonstrates a clear path to sustainable profitability or continues to prioritise growth investment. A positive surprise on net income could trigger significant multiple re-rating as the company transitions from growth speculation to earnings story.

A strong earnings beat 4 particularly one demonstrating unexpected margin expansion or user growth acceleration 4 would fundamentally transform MATH's narrative from "promising but unproven" to "validated execution machine." This catalyst has the potential to unlock institutional buying interest that currently remains sidelined awaiting financial confirmation. The 40-day countdown represents both opportunity and risk, as the market increasingly prices in expectations ahead of the release.

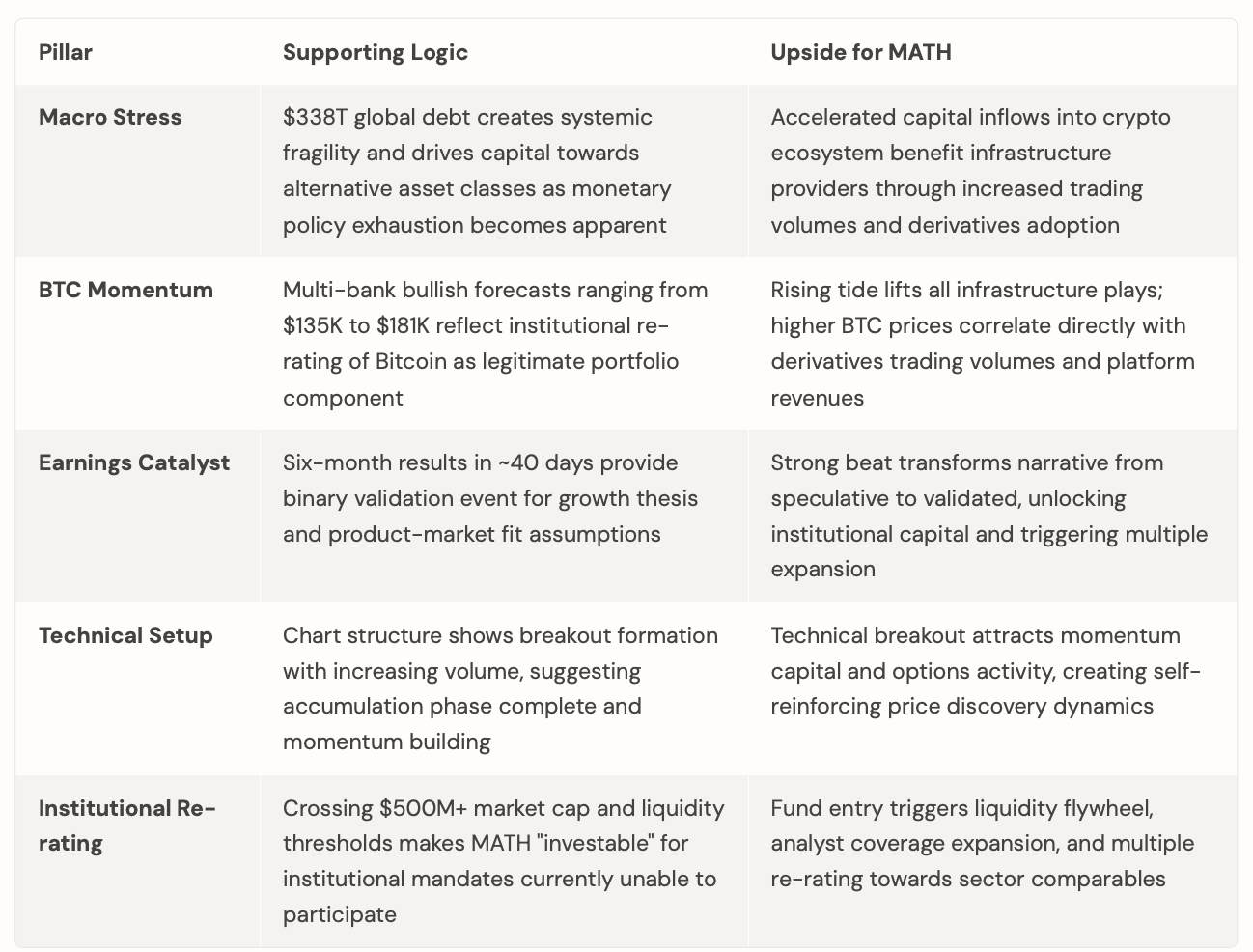

The Five Pillars of the MATH Thesis

The investment case for MATH rests on five independent yet mutually reinforcing pillars, each of which creates asymmetric upside whilst collectively forming a "perfect storm" setup that rarely emerges in public markets. Understanding how these elements interact and compound is essential to appreciating the magnitude of potential re-rating.

The critical insight is that these pillars don't simply add linearly 4 they multiply. Macro stress drives BTC higher, which increases MATH's revenue potential, improving earnings surprise magnitude, which attracts technical momentum buyers, pushing market cap above institutional thresholds, unlocking new capital sources. This cascading effect explains why the setup qualifies as "perfect storm" rather than merely "attractive opportunity."

Disclaimer

CRG.AI is not operated by a licensed broker, a dealer, or a registered investment adviser. This content is for informational purposes only and is not intended to be investment advice. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, or offer by CRG.AI or any third party service provider to buy or sell any securities or other financial instruments. All content in this article is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in this article constitutes professional and/or financial advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. CRG.AI is not a fiduciary by virtue of any persons use of or access to this content.

This article is for informational purposes only and should not be considered financial or investment advice. The content reflects the author's views based on publicly available information but does not constitute a recommendation to buy or sell any securities. Cryptocurrency and equity investments carry risks, including market volatility and potential loss of capital. Investors should conduct their own research and consult a professional financial advisor before making any investment decisions. Past performance is not indicative of future results.

Disclosure & Disclaimer Statement

Ownership Disclosure

As of the date this content is published, I, the owner/operator of this website: www.crg.ai

hold a long position in the publicly traded securities of Metalpha Technology Holding Ltd. (NASDAQ: MATH). I may buy or sell shares at any time without notice.

No Compensation for Report

The report linked or posted on this website regarding Metalpha Technology Holding Ltd. (NASDAQ: MATH) was not commissioned, purchased, or solicited by me or this website. I did not receive any form of direct or indirect compensation—monetary or otherwise—for publishing or sharing this report. I am merely reposting or referencing it for informational and educational purposes.

Third-Party Content Disclaimer

This report was authored by a third party not affiliated with this website. I make no warranties or representations as to the accuracy, completeness, or reliability of the information, forward-looking statements, or opinions contained within. Readers are encouraged to verify all claims independently and consider the source of the report.

Investment Risk & No Investment Advice

The information presented on this website, including this report, is provided strictly for informational purposes and does not constitute an offer to buy or sell any securities. It should not be construed as personalized investment advice or a recommendation to make any specific investment decision. Investing in securities is inherently risky and may result in the loss of your entire investment.

Compliance with SEC Rule 17(b)

In accordance with Section 17(b) of the Securities Act of 1933, while I have not been compensated by any third party to distribute or promote this report, I am disclosing my ownership in the security mentioned. I am committed to full transparency regarding any and all positions held or compensation received related to any content posted on this website.

Forward-Looking Statements Warning

Any statements contained in the report that are not historical facts may be forward-looking statements as defined under federal securities laws. Such statements may involve risks and uncertainties that could cause actual results to differ materially. Readers should not place undue reliance on forward-looking statements and are encouraged to consult with a qualified investment advisor or legal counsel before making investment decisions.

Contact for Questions

For questions or concerns regarding this disclosure, please contact:

Sergei Stetsenko, CEO

www.crg.ai

s.serge@gmail.com

Ownership Disclosure

As of the date this content is published, I, the owner/operator of this website: www.crg.ai

hold a long position in the publicly traded securities of Metalpha Technology Holding Ltd. (NASDAQ: MATH). I may buy or sell shares at any time without notice.

No Compensation for Report

The report linked or posted on this website regarding Metalpha Technology Holding Ltd. (NASDAQ: MATH) was not commissioned, purchased, or solicited by me or this website. I did not receive any form of direct or indirect compensation—monetary or otherwise—for publishing or sharing this report. I am merely reposting or referencing it for informational and educational purposes.

Third-Party Content Disclaimer

This report was authored by a third party not affiliated with this website. I make no warranties or representations as to the accuracy, completeness, or reliability of the information, forward-looking statements, or opinions contained within. Readers are encouraged to verify all claims independently and consider the source of the report.

Investment Risk & No Investment Advice

The information presented on this website, including this report, is provided strictly for informational purposes and does not constitute an offer to buy or sell any securities. It should not be construed as personalized investment advice or a recommendation to make any specific investment decision. Investing in securities is inherently risky and may result in the loss of your entire investment.

Compliance with SEC Rule 17(b)

In accordance with Section 17(b) of the Securities Act of 1933, while I have not been compensated by any third party to distribute or promote this report, I am disclosing my ownership in the security mentioned. I am committed to full transparency regarding any and all positions held or compensation received related to any content posted on this website.

Forward-Looking Statements Warning

Any statements contained in the report that are not historical facts may be forward-looking statements as defined under federal securities laws. Such statements may involve risks and uncertainties that could cause actual results to differ materially. Readers should not place undue reliance on forward-looking statements and are encouraged to consult with a qualified investment advisor or legal counsel before making investment decisions.

Contact for Questions

For questions or concerns regarding this disclosure, please contact:

Sergei Stetsenko, CEO

www.crg.ai

s.serge@gmail.com